In 2022, the solar panel installation craze swept through neighborhoods, with nearly 700,000 homeowners joining the green energy movement. Over the past three years, over 500,000 homeowners transformed their backyards into personal oases by installing new pools. In urban areas such as Seattle, building trends have shifted and more ADUs are being permitted and constructed than single-family homes.

Over the years, roofs aged, vegetation flourished, and property debris accumulated, and now insurers are faced with a challenge – how to safeguard against premium leakage and the escalating risk factors associated with these gradual changes.

Over the years, roofs aged, vegetation flourished, and property debris accumulated, and now insurers are faced with a challenge.

Traditionally, insurers relied on self-reported updates from policyholders and periodic inspections to identify evolving risks. However, self-reported data is notoriously unreliable, and inspections are costly and infrequent.

More recently, carriers have turned to computer vision models for one-time cleanups. But these one-time cleanups are typically limited to geospatial imagery only, aren’t calibrated to the carrier’s risk tolerance, and are only point-in-time solutions, not solving the long-term issue of accumulated risk over time.

ZestyAI Change Detection: A New Approach

ZestyAI offers a robust change detection solution for property portfolio management, emphasizing the ease of catching property changes to reduce accumulated risk, capture additional premiums, apply loss control measures, and modify schedules.

Unlike conventional methods, ZestyAI provides continuous monitoring, keeping a vigilant eye on each property in a portfolio. The platform identifies changes calibrated to individual carriers' risk tolerance, enabling a proactive approach to risk reduction, enhanced premium capture, and schedule modification. This approach ensures agents and policyholders stay well-informed about alterations that may impact risk and property value and enables the carrier to take proactive loss control measures.

Unlike conventional methods, ZestyAI provides continuous monitoring, keeping a vigilant eye on each property in a portfolio.

ZestyAI's platform extends beyond imagery-only solutions, incorporating non-imagery data sources such as building permits and GIS data. From roof damage to renovations, the platform alerts carriers to significant changes in the built environment. This proactive and highly accurate monitoring is a critical input at renewal, allowing carriers to prioritize re-inspection efforts and take action to control losses like letters of repair. It even extends to climate risks, enabling carriers to monitor for changes in exposure and concentration.

Additionally, ZestyAI has introduced several new features available now and in early 2024 to enhance change detection further.

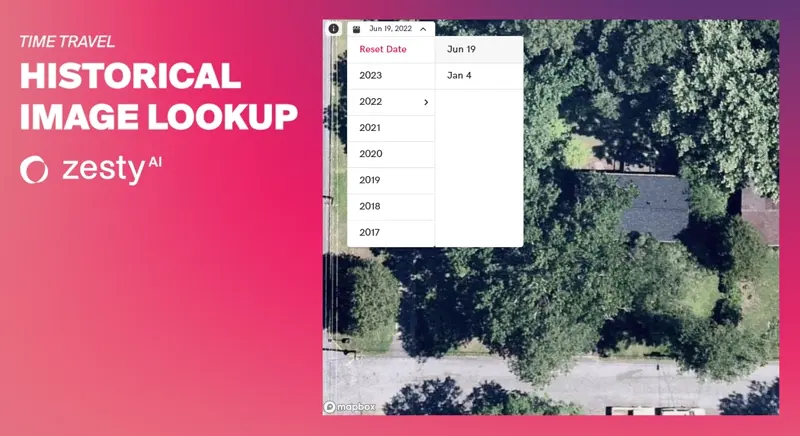

Historical Image Lookup

Addressing the need for proof of degradation required by certain states, this feature allows carriers to "time travel" to multiple years in the past to prove the property condition has degraded since the time of the quote. This capability is invaluable for taking necessary policy actions without relying solely on in-person inspections.

Underwriters also use Historical Image Look Up to gain insights into previous policy decisions, get the full picture of the property, and foster better decision-making moving forward.

Historical images give underwriters insights into previous policy decisions

Underwriter Dashboard

Integrated into Z-VIEW, ZestyAI's web interface, the Underwriter Dashboard consolidates all property information and climate risk scores in one place and highlights what matters. This streamlines the property review process, improving underwriting accuracy and throughput, and reduces the time underwriters spend on each property. Importantly, Z-VIEW and the Underwriter Dashboard are easily accessible via a web browser without requiring IT integration.

Underwriter Dashboard consolidates all property information and climate risk scores in one place and highlights what matters.

Building Permits Summaries

Americans are projected to spend half a trillion dollars on home renovations in 2024, and projects such as additions, upgrading roofing materials, and adding solar panels have a significant impact on premiums and risk for insurance carriers. ZestyAI leverages generative AI to extract valuable information from building permits. This feature provides underwriters with human-readable summaries of recent building permits, saving time and effort in navigating through potentially hundreds of pages.

ZestyAI prioritizes the most significant changes to the property and when they occurred, giving underwriters the tools they need to assess changes in coverage amounts and risk. With the surge in home price inflation in recent years, it’s more important than ever to ensure TIVs are accurate and reflect the dramatic changes in the market.

Kitchen Age and Bathroom Age

A significant portion of the half-trillion-dollar renovation investments homeowners will make this year will be put into kitchens and bathrooms. Carriers need to know when these upgrades have been made and account for upgraded materials and replacement costs. ZestyAI’s Kitchen Age and Bathroom Age features give carriers insight into which a change has been made, and accurately price for the risk.

Change Detection in Action

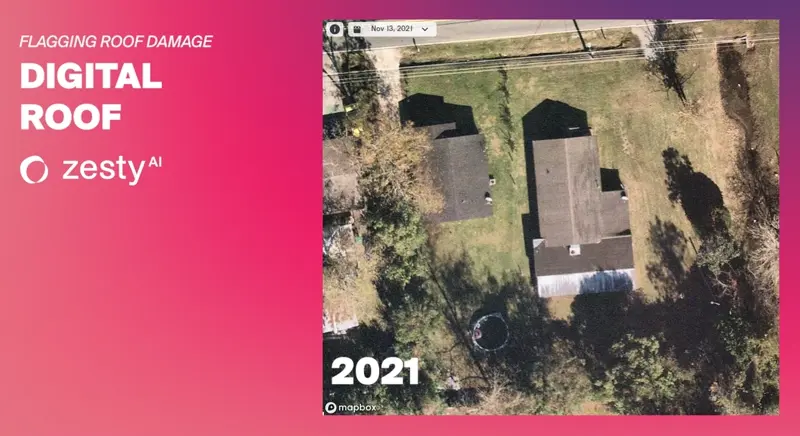

In a real-world demonstration, ZestyAI partnered with a national carrier to analyze their book and showcase change detection in action. ZestyAI analyzed a sample of about 15,000 parcels using our Z-PROPERTY suite, consisting of Location Insights and Digital Roof. Here’s a glimpse into the findings:

Roof Degradation

ZestyAI found over 2% of roofs that had significantly degraded with minor or major damage. Digital Roof found properties with tarps, missing shingles, and metal deterioration. Using conservative assumptions for claim frequency and severity, this single change detection variable alone represented an opportunity to reduce the loss ratio by nearly a half-point.

Detecting changes to roofs can offer a significant reduction in loss ratio

Lot Debris

Another 2% of properties had accumulated lot debris. Junk cars, construction waste, and other debris were detected that represented significant liability risk and required action, from a letter of repair to non-renewal.

Overhanging Vegetation

Over 5% of properties were observed to have a significant increase in overhanging vegetation. These properties represent an increased risk to the carrier where the homeowner may not be maintaining their property appropriately.

Premium Leakage

ZestyAI identified over 10% of properties with potential premium leakage: Adding square footage or secondary structures, solar panels, swimming pools, or trampolines. Surprisingly, about 20% of properties that the carrier had previously identified as equipped with solar panels had expanded their solar footprint since the time of the quote, increasing the square footage of panels.

Overall, after accounting for overlap with multiple changes, ZestyAI typically detects between 10% and 20% of properties had a meaningful change detected on the parcel. ZestyAI's change detection technology not only identifies risks but empowers carriers to take timely actions, enhancing overall risk management strategies.

Carriers now have a playbook to meaningfully improve their combined ratio through loss avoidance actions, TIV correction, capturing additional premium, improving product fit, and optimizing OPEX, such as inspections.

In a rapidly evolving landscape, ZestyAI is the ally insurers need to stay ahead of property changes, ensuring a secure and profitable future.

See For Yourself

Book a demo with ZestyAI to see Change Detection in action.

--------------------

Sources:

1. www.seia.org/research-resources/solar-market-insight-report-2022-year-review

2. s3.amazonaws.com/b2icontent.irpass.cc/603/189950.pdf

3. www.seattletimes.com/seattle-news/politics/seattle-is-now-building-more-adus-than-single-houses/

4. www.architecturaldigest.com/reviews/home-improvement/home-renovation-facts-statistics

.png)